Structure of Government Budget in India

The structure of Government budget in India or the basic framework of any government budget is almost similar for the Governments

at different levels but the sources of revenue and the items of expenditure are different for each budget. The Governments at different levels

prepare their budgets (like the Union Budget of India, the State Budgets, etc.), which contain the estimates of the anticipated revenue and the

proposed expenditure. Every year, the Department of Economic Affairs in the Union Ministry of Finance presents the Economic Survey of

India in the Parliament before the introduction of union budget.

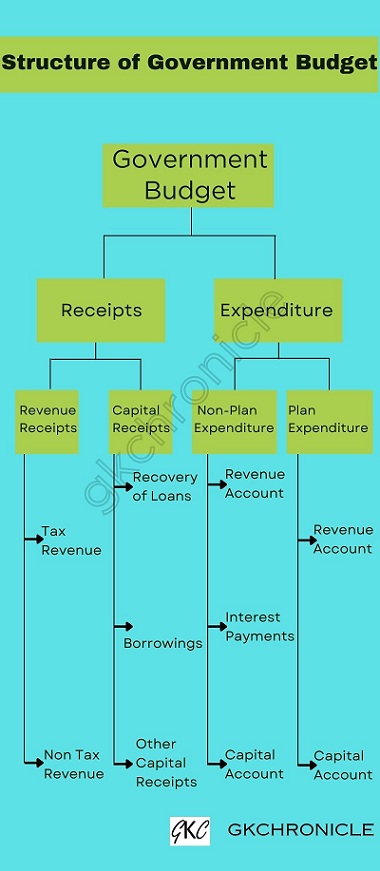

Components of Budget in India

- The components of budget in India will have a Receipts side and an Expenditure side. The Receipt side will have Revenue

Receipts and Capital Receipts and the Expenditure side will have Plan Expenditure and Non-plan Expenditure.

- Here is the basic structure of Union Budget or State Budget or Local Government in India -

| Receipts |

Expenditure |

1. Revenue Receipts

(a) Tax Revenue

(b) Non Tax Revenue (Royalty from Mining, Forestry,

UPSC applications) |

4. Non-Plan Expenditure (Non-Development Expenditure)

(a) Revenue Account

(b) Interest Payments

(c) Capital Account (Purchase of machinery, etc.) |

2. Capital Receipts

(a) Recovery of Loans

(b) Other Capital Receipts (Disinvestment, Selling of Assets, etc.)

(c) Borrowings |

5. Plan Expenditure

(a) Revenue Account

(b) Capital Account |

| 3. Total Receipts (TR) ( 1+2 ) |

6. Total Expenditure (TE) ( 4+5 ) |

- 7. Revenue Deficit (RD) = Revenue Expenditure - Revenue Receipts ( 4a+5a-1 )

- 8. Budget Deficit (BD) = TE - TR ( 6-3 ) = 0 (Because of Deficit Finance)

- 9. Fiscal Deficit (FD) = TE - ( TR - Borrowings )

- 10. Primary Deficit = FD - Interest Payments

- Generally, all the above 4 Deficits are worked out as a percentage of GDP at current prices.

- For reducing the Revenue Deficit in the Government budget in India, the Government should either increase the tax base or decrease the

unproductive expenditure.

Quiz

- Match different types of Deficits in the Annual Financial Statement with their definitions:

- Primary Deficit

- Budget Deficit

- Fiscal Deficit

- Revenue Deficit

- Revenue Expenditure - Revenue Receipt

- Total Expenditure - Total Receipts excluding Borrowings

- Total Expenditure - Total Receipts

- Total Expenditure - Total Receipts excluding Borrowings - Interest Payments

- a-4, b-3, c-2, d-1

- a-3, b-4, c-2, d-1

- a-3, b-4, c-1, d-2

- a-4, b-3, c-1, d-2

Answer

Ans: A

- Who publishes Economic Survey of India?

- NITI Aayog

- Indian Statistical Institute

- Ministry of Finance

- Ministry of Commerce and Industry

Answer

Ans: C